- InvestorThread

- Posts

- Buy Canadian Index: How Canadian Is Restaurant Brands International?

Buy Canadian Index: How Canadian Is Restaurant Brands International?

By Will Ashworth

Like most Canadians, I’ve made an effort to buy domestically for two reasons: It’s a patriotic thing to do. Secondly, anything that will hurt the American economy to the point where Trump wisely says “Uncle” is 100% the goal of Canadians. Vive le Canada!

As I said in my last post, the Buy Canadian movement got me thinking about investing in Canadian stocks. It’s one thing to determine whether a product is genuinely Canadian, but it’s another to determine a public company’s Canadian bona fides are.

I mentioned Alimentation Couche-Tard (ATD), one of the world’s largest convenience store operators. Based in Montreal, just 13% of its 16,861 convenience stores are located in Canada, and the country accounts for just 12% of the company’s revenue. Further, there’s a good chance its ownership profile skews non-Canadian.

Further, exclusively owning Canadian stocks isn’t the wisest idea, given that Canadian markets account for just 2% of the $60.1 trillion global market cap. Toronto’s Globe and Mail has plenty of articles explaining why looking for stocks outside Canada’s borders makes sense.

Performance is a big one. It's no secret that the S&P 500 index has easily outperformed Canadian stocks for decades. Given the Trump government’s insistence on destroying American exceptionalism, whether this outperformance will continue is up for debate.

But I digress.

In my last post, I said I would highlight Canadian stocks to buy that meet three conditions: They’re listed on the TSX or TSX Venture; They generate 50% of their annual revenue from Canada; and, They are 51%-owned by Canadians.

Thinking about it in the days since I’ll also consider the number of Canadian employees as a fourth factor for the Buy Canadian Index.

First up is Restaurant Brands International (QSR), owner of the iconic Canadian Tim Hortons restaurant chain.

Listed on TSX since 2006

Tim Hortons’ history as a public company is long and winding. It was privately owned until 1995, when Wendy’s (WEN) acquired it for $580 million (all figures are U.S. dollars unless noted otherwise).

Tim Hortons remained a separate company for eight years until Burger King acquired it in December 2014. The merger, which created Restaurant Brands International, was valued at $11.4 billion.

Tim Hortons has been a public company for 29 years, although it has been independent for just eight. RBI's trading on the TSX is an insignificant nod to Canada.

So, here’s how to measure a Buy Canadian stock for its trading exchange:

10 points - A stock is listed only on a Canadian stock exchange.

6 points - A stock is dual-listed on a Canadian and foreign exchange.

3 points - A stock is only listed on a stock exchange outside Canada.

On this scoring method, Restaurant Brands gets 6 out of 10 points.

Restaurant Brands’ International Revenue

As of Dec. 31, it had 4,751 locations in Canada out of 32,125 (15%) worldwide, with 3,886 Tim Hortons, 381 Burger King, 372 Popeyes, and 112 Firehouse Subs. Its global system-wide sales were $44.48 billion.

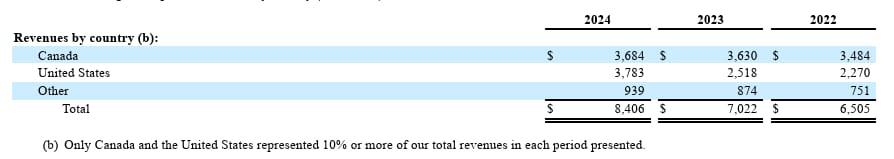

Based on 15% of the stores, I’ll estimate that its Canadian system-wide sales were $6.67 billion in 2024, well less than 51%, making it non-Canadian by the revenue metric. On pg. 101 of its 2024 10-K, the revenues from Canada were $3.68 billion, or 44% of its worldwide revenue of $8.41 billion.

It’s important to remember that system-wide sales are from all 32,125 locations. In contrast, the revenue on the company's income statement includes sales from its company-owned locations and franchise royalties from its franchisees.

10 points - A stock generates 75% of its revenue in Canada.

6 points - A stock generates 50.1% to 74.9% of its revenue in Canada.

3 points - A stock generates 50.0% or less of its revenue in Canada.

On this criterion, Restaurant Brands gets 3 out of 10 points.

A Mixture of Brazilian and U.S. Ownership

Restaurant Brands’ largest shareholder is Brazilian private equity firm 3G Capital affiliates. In an August 2024 SEC filing, 3G said it owned 116.78 million shares of the company, which represents 26.9% of the restaurant operator’s outstanding stock.

According to a Sept. 30, 2024, 13G filing with the SEC, the second-largest shareholder is Los Angeles-based institutional investor Capital Research Global Investors. It owns 11.3 million shares, representing 3.5% of its stock, down from 9.5% in the company’s 2024 proxy statement.

However, that’s only one of the holdings reports filed by Capital Research. A big one that an investor might miss is for Capital World Investors. At the end of December, it held 43.4 million company shares. According to S&P Global Market Intelligence, Capital Research owns 55.3 million shares, representing 17.0% of its stock.

According to an SEC 13F holdings report from Dec. 31, 2024, the next largest shareholder is Pershing Square Capital Management, the hedge fund of billionaire activist Bill Ackman. It owns 23.0 million shares of Restaurant Brands stock, accounting for 7.0% of the company's stock.

These three foreign investors combined own 50.9% of Restaurant Brands’ stock.

10 points - Canadian investors hold 75% of its shares or more.

6 points - Canadian investors hold 50.1% to 74.9% of its shares.

3 points - Canadian investors hold 50.0% or less of its shares.

On this criterion, Restaurant Brands gets only 3 out of 10 points.

But How Many Employees Are Canadian?

According to an estimate from well-known Toronto employment lawyer Samfiru Tomarken, Starbucks (SBUX) has 23,000 Canadian employees. While Canadians might be tempted to boycott the Seattle java purveyor’s stores, the company pays well, provides excellent benefits relative to the rest of the restaurant industry, and offers opportunities for advancement across the country.

In recent years, many news stories have been about poor human resources practices at Restaurant Brands’ corporate offices and its many franchisees nationwide.

Who knows what’s true and what isn’t? However, where there’s smoke, there’s usually fire.

Determining the number of Canadian employees at Restaurant Brands International is difficult. S&P Global Market Intelligence says the company has 37,600 worldwide, derived from its 2024 10-K. The 10-K says that it has 2,100 corporate employees working in Canada, but it does not break out the numbers employed by Canadian franchisees.

Assuming the average franchised location employs 25 people and 35% of its 16,486 North American restaurants are located in Canada, that’s 144,253. While that seems high, half of that would be a reasonable guess.

With 32,125 restaurants worldwide and approximately 18% of them in Canada, Canadian employees are unlikely to account for more than 25% of its total workforce.

10 points - 75% of its employees are based in Canada.

6 points - 50.1% to 74.9% of its employees are based in Canada.

3 points - Less than 50.0% of its employees are based in Canada.

On this criterion, Restaurant Brands gets 3 out of 10 points.

Is Restaurant Brands International Eligible for the Buy Canadian Index?

With 15 out of 40 points, it does not meet the 28-point minimum to qualify.

Disclaimer: The author did not hold a position in any of the securities mentioned above. The information provided in this article is for educational and informational purposes only and should not be construed as investment advice. Always conduct your own research or consult with a licensed financial professional before making any investment decisions. Past performance is not indicative of future results.

Will Ashworth is currently ranked 205 out of 30,878 financial bloggers analyzed by TipRanks, with a 14.8% return on his buy and sell ratings. He is one of the founding contributors to this newsletter.

Will has written about investments full-time since 2008. Publications where he’s appeared include InvestorPlace, The Motley Fool Canada, Investopedia, Kiplinger, and several others in both the U.S. and Canada. He particularly enjoys creating model portfolios that stand the test of time. He lives in Halifax, Nova Scotia.